Economist Gary Stevenson points out that the wealth of the very rich has grown so much that they are buying assets, such as property, forcing up prices for everybody else: Fewer people can afford to buy their own homes. Stevenson”s advocates taxing wealth to stop the rich getting too rich.

For the present, he avoids being to specific about the exact nature of a wealth tax. Here, I propose two specific solutions. First: taxing property and returning the proceeds equally to each of UK’s 52 million adults. Second: Taxing land to do the same. I have developed these with the help of the chatbot, Claude AI.

A property tax

According to ClaudeAI, UK national wealth totals £12.2 trillion. (That’s an average of £200,000 per UK adult.) The value of UK property is £10.4 trillion so property is 85% of national wealth. At present annual taxes on property (council tax and business rates) total £70 billion, less than 1% of total UK property value.

A extra tax on property of 2.5% per annum could pay £5000 to each UK adult. For those with no property this would add £5000 to their income. The very rich would loose nearly 2.5% of their property wealth each year (approximately 2.125% of their total wealth). On the assumption that property values don’t change much, the total wealth of the richest would halve in just over 30 years.

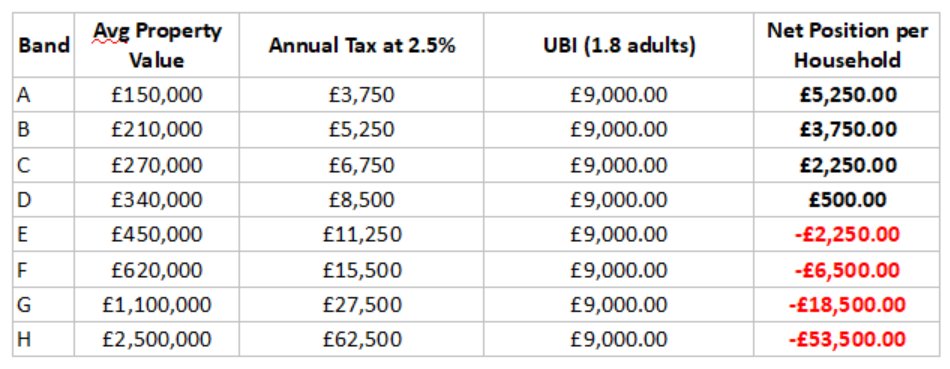

This scheme would affect different groups in different ways. If the property tax did not fall on renters, each individual would be £5000 a year better off. For home owners, assuming an average of 1.8 adults per household across all bands, for each council house tax band, we have:

But owner occupiers living singly would be hit. For example, in the mid-range Council Tax Band D they are £3,500 per year worse off.

There are different ways to soften the blow for singles in the more expensive houses. One way is to give tax relief on the property: At present council tax is reduced by 25% for single occupiers. Another possibility is for the state to take a charge on their home to be repaid on sale or the death of the home owner. These measures would help the asset-rich-but-cash-poor individuals and families.

A tax on land value

Land value in UK totals £5.85trillion or 48% of national wealth. A 4.4% tax on land would allow the same yearly payments (of £5000) as a 2.5% property tax. Again that would halve the wealth of the richest in just over 30 years.

It should be noted that nearly all of the “land value” in the UK is the right to locate buildings on the land they occupy. From the ONS data, land underlying dwellings is: approximately 60% of the value of all property.

This explains why taxing land value is a politically attractive issue – the granting of planning permission creates a massive windfall gain that is captured by landowners rather than the public, even though it’s a policy decision by government that creates this value. Also a tax on land value does not penalise improving property.

Land value taxation was made popular by the economist Henry George . His most famous work, Progress and Poverty (1879), sold millions of copies worldwide. He believed that people should own the value of what they produce themselves, but that the economic value of land should belong equally to all members of society.

Property and land cannot be exported

That’s two choices of mechanism for a wealth tax. Both show that billionaires can’t easily take their most of their wealth with them if they leave the country. Neither land nor property can be exported.